As we write this on March 12th, the S&P 500 is flirting with a peak-to-trough 10% correction, while the tech-heavy NASDAQ crossed that threshold over a week ago.

Let’s be honest—we were probably due. The S&P 500 just posted its best back-to-back calendar years since 1998. Meanwhile, the US economy is digesting a transition from US government fueled jobs to US private sector jobs. This transition is needed for longer term growth but the path to this endpoint will be filled with potholes.

Investing in equities and other higher-risk assets is about positioning for long-term growth. These allocations fund your future spending needs and retirement. Market corrections—where stocks pull back from speculative highs—are never comfortable but are healthy and natural “clearing” mechanisms.

How natural, you ask? For perspective, Dimensional Fund Advisors looked at the U.S. stock market from 1979 to 2023 and asked a simple question: How much did the market decline at some point during each year?[i] The average intra-year drop was -14%. Let that sink in. We haven’t even hit that average number in 2025. But when we zoom out, 37 of the past 45 years still ended in positive territory, with the market compounding at a strong 12.0% per year. Short-term drawdowns like the past few weeks go hand-in-glove with long-term returns. In other words, we should expect this feeling almost annually.

Easy, right? Well, not if the financial press has anything to do with it. Take this recent headline: “How the U.S. economy went from booming to a recession scare in only 20 days.” Your emotions fuel their clicks. And the narrative is always different, always “unprecedented” as we learned from Yoda and a Nobel Prize winner.

Will the U.S. slip into a recession? We don’t know.

Will tariffs lead to a debilitating trade war? We don’t know.

Will inflation surge again, driving rates higher? Say it with us—we don’t know.

What we do know: Structure, preparation, and process matter more than predictions. While we have little faith in crystal balls (ours or anyone else’s), we do believe your portfolio is structured for efficiency, prepared for resilience and built on a disciplined “All Seasons” process for reliability.

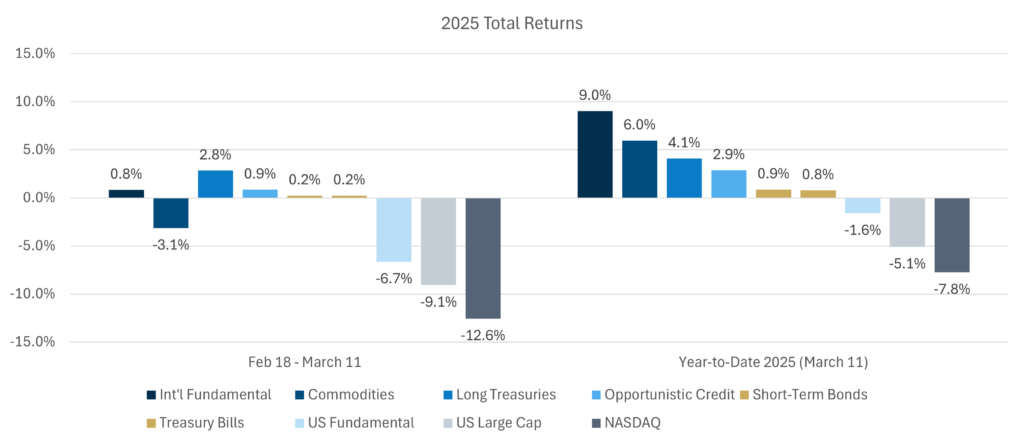

Your household is positioned for short-term market turbulence via a Protective Reserve, and for long-term growth through a diversified All Seasons Growth Assets portfolio. Since the S&P 500 started its decline on February 18:

Short-term bonds and Treasury Bills—a proxy for Protective Reserve assets—are up +0.2%

Long-term Treasury bonds—a key risk diversifier—are up over +3.5%

Inflation-Protected Bonds & Municipal Bonds—also slightly positive

Opportunistic Credit—holding up well, a good sign that credit markets aren’t signaling deep economic stress.

Developed International Stocks—left for dead 10 weeks ago—are actually positive this correction and up nearly +9% year-to-date.

Of course, this is a very short time frame. Every market correction looks different, and this one may evolve further. But it underscores why a disciplined, All Seasons approach matters.

Let us know if you would like to discuss further. Markets fluctuate. Priorities change. We’re here to help.