Yes! Recent legislative changes allow distributions from 529 accounts to also provide a retirement boost to the beneficiary (i.e.the student.) Starting next year, up to $35,000 from a 529 account can be converted to a Roth IRA owned by the 529 beneficiary for at least 15 years, without incurring any taxes or penalties.

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future college costs. Earnings and withdrawals are generally exempt from federal income tax. The money saved in a 529 plan can be used towards college tuition, fees, and the like. But the savvy parent may want to reserve the last $35,000 and convert to a Roth IRA for their child.i

What’s that worth?

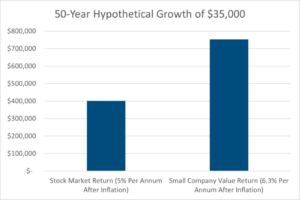

A lot. Albert Einstein once quipped that man’s greatest invention was compound interest. And five decades between college graduation and retirement is a lot of time for compounding. If we assume a 5% real (after inflation) rate of return, the $35,000 grows to a little over $400,000 in today’s dollars. As a reference, the S & P 500 Index of large company US stocks has grown by 7% real (after inflation) since 1926.ii

But the other thing about compound interest is that little differences can lead to very meaningful ending values. The operative words here are “little” and “value”. Gene Fama of the University of Chicago won a Nobel Prize for his work on the cross section of stock market returns, where he and coauthor Kenneth French discovered that small company and value stocks provided higher long-term returns.iii They concluded this was the result of increased risk. Small company stocks are more likely to fail than large companies. Value stocks, those that have cheaper valuations like Price-to-Earnings, may be more prone to distress.

How much more return? Fama and French’s work extended through June 2023 showed small value stocks beat the S & P 500 by 3.9% per annum, over nearly the past 100 years.iv Dimensional Fund Advisors launched a small company value mutual fund in 199x to capitalize on this discovery. With thirty years of live data, the DFA Small Company Value Fund beat the SPY by 1.3% per annum after fees.v

After taxes, this delta would shrink by about half. A small company value strategy, even one linked to an index, requires more trading and rebalancing than an S & P 500 Index. That “maintenance” leads to more capital gains taxes that interrupt compounding.

But guess what? The Roth IRA never pays taxes!

Let’s put it together. If we add a 1.3% per annum small company value premium to our 5% expected return for the S & P 500, what happens to the magic of compounding over fifty years? Remarkably, we see our balance nearly double to $753,000! In other words, an initial Roth IRA balance grows to over 21 times its initial value…in today’s dollars.

The information contained above is for illustrative purposes only. The above targets are estimates based on certain assumptions and analysis made by the advisor. There is no guarantee that the estimates will be achieved.

Of course, this is hypothetical. Past returns, even those with conservative estimates, won’t necessarily repeat. Further, it’s always best to consult with a tax professional regarding your specific circumstances. But, it does show the power of compounding. And we believe it’s a neat new tool to set up the next generation for a fulfilled life. And isn’t that what college is all about?