Our clients get asked routinely to invest in new ventures. Bottom line? Understand your odds going in with eyes wide open. Then let your priorities drive your investment decisions, not the other way around.

Clients and friends of Flatrock know we emphasize “preparation over prediction.” This is particularly true in a startup. Predicting the likely path of a new business idea is nearly impossible when so many of the variables – management, product, execution, legal, funding, the macro environment, etc. – are unknown.

Like little sea turtle hatchlings, a lot can go wrong when a new company leaves the nest of an idea and enters into the real world. Even the best of ideas can fail due to poor execution or bad luck.There is just no way to tell. Prediction is futile.

So how can we prepare to invest in a seed venture? We lay out below a two-stage framework based on the evidence of Venture Capital (VC) returns and how to tie this knowledge into your own unique financial plan. The framework has the added bonus of making it less personable to turn down deals tied to friends or family.

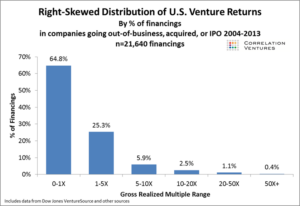

To start, the empirical evidence in venture capital is all about “positive skew.” John Cochrane of the University of Chicago (2001) covered this feature of positive skew in a research paper for the National Bureaus of Economic Research over twenty years ago. iAnd we further accentuate it below with more recent data.ii

Practically speaking, the chart illustrates that 6-7 of VC financings out of 10 lose money or outright fail. However, there is a smaller subset of investments that generate substantial profits. Thus, the big returns attributed to VC investing are really the result of the very few winners that win in a BIG way.

The takeaway? The expected return is basically a loss on a company-by-company basis. The numbers in the chart (derived from over 21,000 observations) say you can expect your “one company investment” to be a loss, with a decent chance of a total write-off.

Thus, the best way to invest in seed, early-stage VC is to do so with breadth, where you invest across multiple companies in a fund format. In addition to sourcing the deals, VC funds often bring some degree of managerial, strategic, and/or operational know-how. I’ve seen this in my volunteer experience where I serve on the University of Arizona Endowment Investment Committee.

But even with all of that expertise, we still see the distribution skewed to a few winners and many, many losers. If the most experienced and proven investors frequently get it wrong with early ventures, then the odds are probably even worse for fundings not led by a VC firm. With these tenets in mind, one-off investments in seed start-ups are best viewed as speculative investments where the *expected* return is a substantive loss, perhaps even a full write-off. Let that sink in for a moment.

But, maybe we are convinced that this investment will be one of the big winners. iiiThe next question is can we afford it and what sacrifices are we willing to bear? This is where Whole Picture Planning can be so helpful. We first measure household Priorities, which include anything requiring capital today or in the future. This includes supporting a no-frills standard of living (Essential Spending).Then we tack on Important priorities such as kids’ wedding expenses, private schools, University education, travel, restaurants, and recreation. And finally Discretionary priorities that we’d be willing and able to downsize during a period of adversity such as charitable donations, kids’ supplemental income, social clubs, second homes, and vessels.

We then compare the total cost of these priorities with the household’s entire balance sheet of resources (what we call the Capital Stack) including investment accounts, personal assets(like primary residence), human capital (i.e. future wages and bonuses), illiquid assets (like private businesses) and pensions (like Social Security.)

The takeaway? Essential and Important life financial priorities should not be tied to these investments. Would you be willing to give one of these priorities up to invest in the startup given the low odds in the chart above? Probably not.

I asked another client who has substantial post-career plans if the VC investment was worth working for a couple of more years. The answer, again, was a resounding “no.”

On the other hand, the trade-off may be worth it if your household has excess, liquid resources beyond *all* of your financial priorities. And, if you’re not sure of either your Priorities or Capital Stack, we would strongly advise establishing a Whole Picture Financial Plan (and deferring the startup investment.)

Markets fluctuate, priorities change. We’re here to help

Resources

- ihttps://papers.ssrn.com/sol3/papers.cfm?abstract_id=255330

- iihttps://www.sethlevine.com/archives/2014/08/venture-outcomes-are-even-more-skewed-than-you-think.html

- iiiThis would hardly be a surprise. Overconfidence and the allure of big payouts are classic cognitive errors in the behavioral finance literature.

Disclosures

Flatrock Wealth Partners LLC (“Flatrock”) is a registered investment advisor.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Flatrock does not offer tax advice. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

External links may contain information concerning investments, products or other information. Flatrock is not responsible for the accuracy or completeness of information on non-affiliated websites and does not make any representation regarding the advisability of investing in any investment fund or other investment product or vehicle. The material available on non-affiliated websites has been produced by entities that are not affiliated with Flatrock. Descriptions of, references to, or links to products or publications within any non-affiliated linked website does not imply endorsement or recommendation of that product by Flatrock, LLC. Any opinions or recommendations from non-affiliated websites are solely those of the independent providers and are not the opinions or recommendations of Flatrock, which is not responsible for any inaccuracies or errors.

Please see our website https://www.flatrockwealth.com/disclosures